Integrating All Aspects of Financial Planning

- Cash Flow, Goal Setting, Investment Strategies

- Insurance Review, Estate Planning, Savings Analysis

- Small Business Planning, Real Estate Analysis

- Charitable Planning, Tax Saving Strategies, Tax Preparation

- Life Enrichment

How We Are Different

Financial Plan & Investments

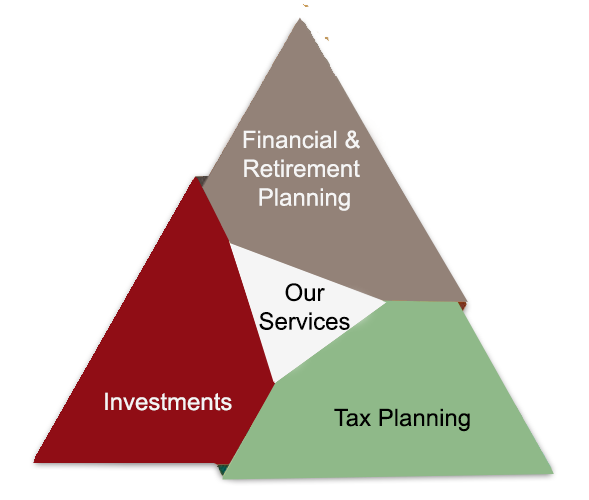

Most financial and investment companies focus on two main areas of financial planning:

- The Financial Plan itself

- The Investments

They (and we) will incorporate some or all the LEFT side of this financial planning triangle in varying degrees. In fact, most financial/investment companies state in disclosures that they do not provide tax advice.

Tax Planning

Three Points Financial proactively integrates the RIGHT side of this triangle into a client’s financial planning. Our services include:

- Ongoing review and implementation of approved strategic tax decisions.

- Preparation (for most of our clients) of individual tax returns.

- Charitable giving planning.

This allows us to address one of the most important aspects of your overall financial plan: How can we help you save on your personal taxes now and in the future?

Life Enrichment

Quality of life is important! We occasionally offer ideas and discussions via blogs, podcasts and videos on topics of interest that tend to enrich our lives.

In Addition

- With current and proposed changes in Income and Capital Gains Tax Rates and potential changes in Estate Planning Thresholds, we will be proactive to identify tax advantages for clients.

- We analyze the financial outcome and timing of buying, holding, or selling rental, business, and other properties.